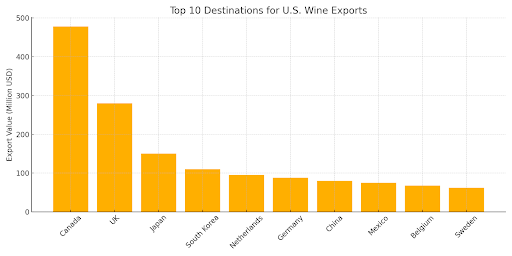

The United States has historically enjoyed a robust trade relationship with Canada in the wine sector. As one of the top three export destinations for U.S. wines, Canada plays a critical role in sustaining the growth and global outreach of American wineries. Between January 2020 and March 2025, U.S. wine exports to Canada saw periods of strong recovery and dramatic setbacks, most notably a historic 72.5% year-over-year collapse in March 2025 following geopolitical tensions and trade policy announcements.

Five-Year Export Trend Overview (2020–2025)

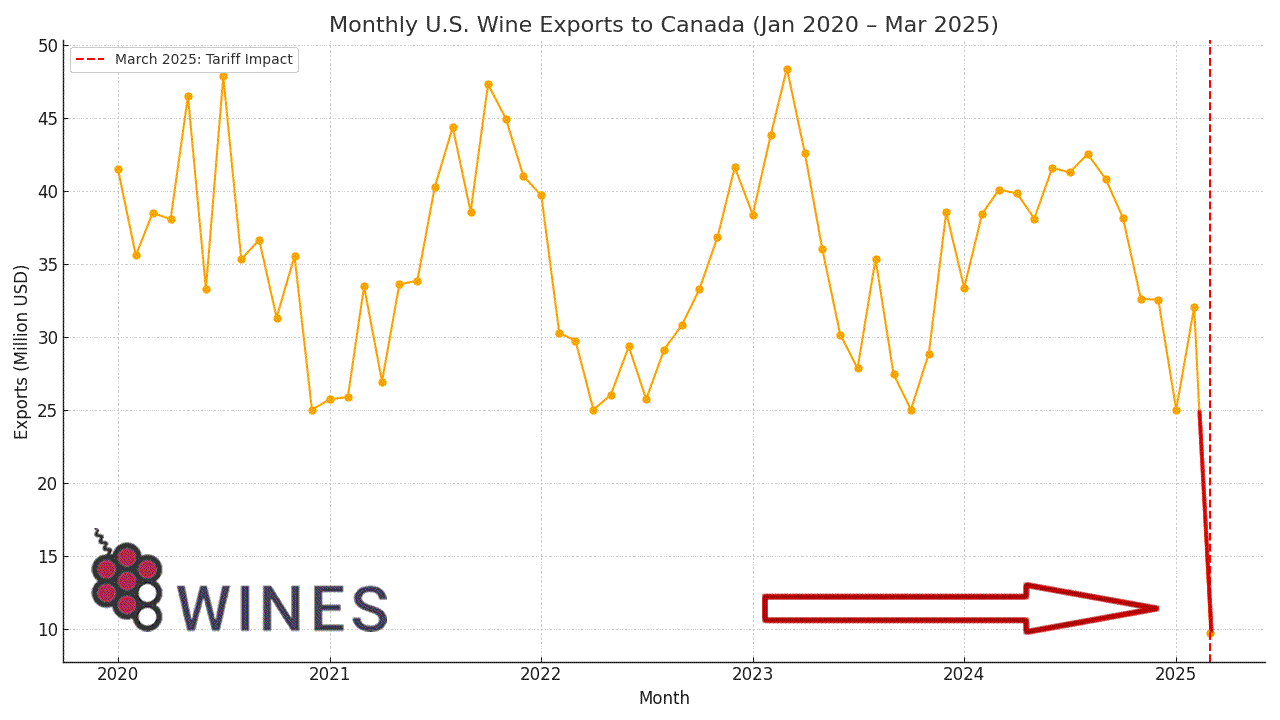

Monthly U.S. wine exports to Canada began 2020 at a healthy pace, with January values close to $35 million. However, the onset of the COVID-19 pandemic introduced significant volatility:

-

2020: Lockdowns led to a temporary plunge, followed by a shift to off-premise retail and e-commerce sales.

-

2021: A strong rebound year, with monthly exports often exceeding $50 million.

-

2022–2023: Stabilization occurred, with monthly averages in the $35–40 million range.

-

2024: Minor contractions due to inflation, exchange rate instability, and cautious liquor boards.

-

2025: March saw a collapse to $9.69 million, marking the worst month in five years.

Illustration: Monthly U.S. Wine Exports to Canada (Jan 2020 – Mar 2025)

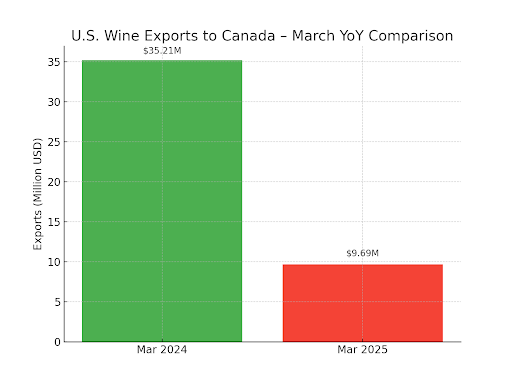

March 2025 Shock: Tariffs and Trade Panic

In early 2025, a public announcement by former President Donald Trump proposed a new round of tariffs targeting Canadian agricultural products. In response, Canadian officials signaled the possibility of countermeasures on U.S. wine and spirits imports. Although the tariffs had not been formally implemented by March, the speculation triggered a massive pullback from provincial liquor boards and private distributors. The result was an unprecedented drop from $35.21 million in March 2024 to just $9.69 million in March 2025—a 72.5% decline.

Illustration: YoY Export Collapse – March 2024 vs March 2025

Factors Behind Export Trends

-

COVID-19 Pandemic: Disruption of supply chains and shift to online retail.

-

Currency Instability: USD/CAD exchange rate impacted competitiveness.

-

Inflation: Rising costs deterred volume purchases.

-

Regulatory Conservatism: Canadian boards adjusted buying behavior.

-

Political Risk: Tariff fears caused purchasing freezes.

Canadian Market Trends and Consumer Behavior

-

Premiumization: Rising demand for higher-priced wines.

-

Eco-consciousness: Interest in organic and sustainable wines.

-

Red Varietals Lead: Cabernet Sauvignon and Pinot Noir dominate.

-

Digital Growth: Surge in e-commerce and DTC models.

Strategic Recommendations for Exporters

-

Expand reach across Canadian provinces beyond Ontario and Quebec.

-

Partner with local importers to navigate regulatory complexity.

-

Leverage digital channels to engage Canadian consumers.

-

Track policy changes and develop logistics contingencies.

-

Focus on quality storytelling and premium branding.

Forecast for 2026

Assuming no formal tariffs are enacted and tensions ease, exports are projected to recover gradually. Distributors are expected to replenish inventories and consumer demand remains strong. Estimated quarterly monthly export averages are as follows:

| Quarter | Projected Monthly Avg (USD Million) |

| Q1 2026 | $18–22M |

| Q2 2026 | $24–28M |

| Q3 2026 | $30–34M |

| Q4 2026 | $35–40M |

Source: U.S. Census Bureau, USA Trade Online. Analysis by 8Wines.com.

Good selection