Introduction

France has the reputation of one of the greatest wine producers in the world and its culture is inseparably connected to winemaking rituals. French people have been enjoying red and white wine with their food and at their social meetings for centuries. Over the years, wine consumption in France has undergone adjustments as a result of an array of factors including health directions, economic conditions, and the developing tastes of consumers. In this broad analysis, we look into the levels per capita consumption and the total wine consumption for the period 2010-2024 in France. Also, we will consider what leads to the yearly changes in the wine consumption as well as the liquors that can be used as an alternative for wine or something that can be substituted with wine.

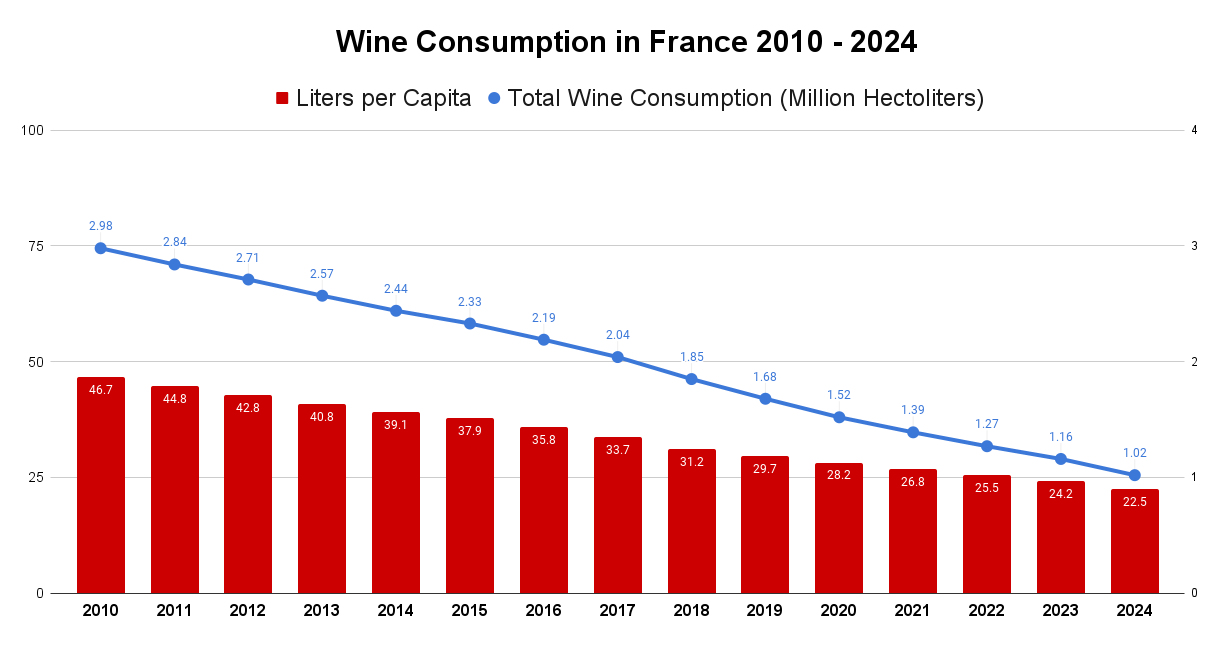

Table: Wine Consumption in France (Liters per Capita and Total Consumption)

| Year | Liters per Capita | Total Wine Consumption (Million Hectoliters) |

|---|---|---|

| 2010 | 46.7 | 2.98 |

| 2011 | 44.8 | 2.84 |

| 2012 | 42.8 | 2.71 |

| 2013 | 40.8 | 2.57 |

| 2014 | 39.1 | 2.44 |

| 2015 | 37.9 | 2.33 |

| 2016 | 35.8 | 2.19 |

| 2017 | 33.7 | 2.04 |

| 2018 | 31.2 | 1.85 |

| 2019 | 29.7 | 1.68 |

| 2020 | 28.2 | 1.52 |

| 2021 | 26.8 | 1.39 |

| 2022 | 25.5 | 1.27 |

| 2023 | 24.2 | 1.16 |

| 2024 | 22.5 | 1.02 |

Yearly Change in Consumption

Growing Popularity of Rosé Wine

The rise in rosé wine sales in the French market has become a key factor of the change of wine industry consumers’ behaviour, leading the way to the appearance of a number of strategic opportunities, both for the leaders and the newcomers in the wine business. The paradigm shift was propelled by the mix of several factors such as evolving taste preferences, social trends and excellent marketing campaigns.

Market figures are showing a definite rise in rosé wine demand, and, roughly speaking, more and more people seem to be enjoying its flexibility, which has resulted in it becoming a year-round category. This tendency makes rosé to be a niche product onto a mega contender, for which marketers and producers should find a strategic readjusting. Industry incumbents benefit from this movement by becoming diversified and investing in the development of rosé production methods . Another strategy that has contributed to the expansion of the customer base beyond its traditional stronghold includes well-crafted brand positioning and a campaign that targets specific groups of consumers.

Economic Factors

Economic factors affect wine demand. The recession or uncertainty of the economy could result in consumers reducing the amount that they are spending on wine and other discretionary items. Economic recessions in some years possibly being one of the reasons for wine consumption fall-outs during those years.

Competition from Other Beverages

In addition to this, different alcoholic and other non-alcoholic beverages came in to make competition. Some others have decided to switch to other alcoholic drinks such as craft beer and spirits that have come up with different flavor options and attract a different social class. Besides, the surge of non-alcoholic choices, like alcohol-free wine and mocktails, have given alternatives to people who don't want to drink alcohol at all.

Generational Shifts

Generation change of consumers has also helped to design wine consumption patterns in the same way. Young adults such as millennials and generation Z like to get the thrill in their life and this is where their taste may differ from their older generations. These generational switches have brought about shifts in beverage preferences, with traditional wines consumption aretreatments.

Wine Culture and Education

Consumers' wine culture and education are important factor in influencing their consumption patterns as well. Wine knowledge and awareness may turn into a more conscious and informed wine consumer. As people learn about various styles of wines, their regions of origin and quality levels, they might decide on buying more high-quality wines or other varieties that they are not used to, and thus overall sales of wine increase.

Substitutes for Wine

With the decrease in wine consumption, a lot of consumers have shifted to alternative drinks. These substitutes can include:

Craft Beer

The craft beer has been in a mainstream in the past few years which offers consumer a wide range of flavors and styles. Some wine drinkers have turned instead to craft beer as an alternative to wine thanks to its taste appeal and ability to deliver an experience of drinking that is unique.

Spirits

The sector of spirits such as whiskey, vodka, gin, and others has grown in popularity. Some wine drinkers have decided to switch to spirits of their choice, such as cocktails and various mixed drinks offering alternative tastes and alcohol content.

Non-Alcoholic Beverages

The incidence of alcohol-free drinks is another problem as people can have an option for people who wish to limit their consumption of alcohol. Nonalcoholic wines, sparkling water, and non alcoholic beverages have all seen a rise in interest from people looking for invigorating and alcohol free beverages.

Conclusion

Worthy noting, the consumption of wine in France has been noticeably different from 2010 to 2024. Numerous determinants such as health concerns, financial conditions, and competition with the other beverages, have moderated these tendencies. The wine industry will have to adapt its production methods according to the changes in consumer demands that come with the changing market trends. Consumption drop of wine is not related to loss of wine’s cultural importance in France, but is rather a sign of transformation in lifestyle and choices. Through the innovation of the wine industry and its ability to cater to the varied tastes of customers, the true manifestation of the French culture will continue to be wine.

FAQs

What were the principal factors that contributed to the drop in wine consumption in France?

-

- The decline of wine drinking in France is related to health movements, economic factors, and the development of wine culture.

What kinds of alcoholic beverage are replacing wine consumed in France?

-

- Among the wine substitutes in France various types of beer are included together with different types of spirits like whiskey, vodka, gin and other. Similarly, the number of non-alcoholic beverages, such as alcohol-free wine and mocktails, is rising, as they are becoming favorite options for those not willing to consume alcohol.

How have generations shifts shaped the rise of wine drinking among the French?

-

- Wine-drinking generation and specially Millennials and Generation Z have shaped the wine consumption habits. Younger age cohorts tend to prefer experiential choices and want different wine flavours, hence they deviate from conventional models of consuming wine.

In what ways does the French wine culture and educational system have an influence on wine drinking?

-

- The increased knowledge of and interest in wine has shaped the consumers, who tend to be more selective. As individuals educate themselves about various wine types, regions, and quality level, they may incline towards superior wine options or discover new varieties. As a result of such circumstances, the total number of the wine consumed by people is affected.

What is the volume of wine consumed per capita in France in the year 2023?

-

- At the end of 2023, every French man or woman was drinking 24.2 liters per person and a total of 1.16 million hectoliters of wine was consumed for the year. This represented a continuation of the falling wine demand in the nation, signifying the health shifts, economic factors and adjusting consumers' preferences.

How much wine French people will same in 2024?

-

- On the chart it is predicted for the wine persistence in 2024 at the consumption of 22.5 liters per capital and the total consumption will be 1.02 million liters.

No problems, arrived quickly and well packaged